Finding reliable, high-quality, and cost-effective cosmetic packaging suppliers can be a global challenge. Navigating international trade, quality control, and logistics adds complexity for any cosmetic brand.

China is widely considered one of the best countries for importing cosmetic packaging due to its vast manufacturing capabilities, competitive pricing, extensive range of options, and well-established export infrastructure, though other countries like South Korea and Taiwan also offer specialized strengths.

Choosing where to source your cosmetic packaging is a strategic decision that impacts your product’s cost, quality, and speed to market. As a premier global packaging manufacturer based in China, we at ShineTop have over 20 years of experience helping brands worldwide. Let’s explore the landscape of cosmetic packaging importation.

Which Country is Best for Cosmetic Products?

The "best" country for cosmetic products can be subjective. It depends on whether you mean innovation, manufacturing, or market size. Different countries excel in different areas of the cosmetics industry.

For cosmetic product innovation and trendsetting, South Korea and Japan are highly influential. For manufacturing volume and diversity, China is a leader. For luxury brands, France and Italy have a strong heritage.

When discussing the "best" country for cosmetic products, it’s important to clarify what aspect we’re focusing on. Several countries stand out for different reasons.

Leading Countries in the Cosmetic Sector:

-

South Korea:

- Strengths: Highly innovative (K-Beauty trends), advanced formulations, cutting-edge ingredients, sophisticated packaging design. Strong focus on skincare.

- Considerations: Can be a source for unique finished products and innovative packaging concepts.

-

Japan:

- Strengths: Known for high-quality ingredients, meticulous research and development (J-Beauty), elegant and functional packaging. Strong in skincare and makeup.

- Considerations: Excellent source for premium finished products and high-precision packaging components.

-

France:

- Strengths: Long heritage in luxury cosmetics and perfumery, strong emphasis on brand storytelling, high-quality formulations, and sophisticated, often classic, packaging.

- Considerations: Home to many iconic luxury brands; a benchmark for quality and prestige.

-

Italy:

- Strengths: Strong in color cosmetics (makeup) manufacturing, particularly for private label. Known for vibrant colors, good quality, and flexible production.

- Considerations: A key hub for makeup formulation and production, often supplying many international brands.

-

USA:

- Strengths: Large and diverse market, strong in both mass-market and indie brands, innovation in direct-to-consumer models, and a wide range of product categories.

- Considerations: A major consumer market and also a source of diverse brands and contract manufacturers.

-

China:

- Strengths: World’s largest manufacturing base for a vast array of goods, including cosmetics and cosmetic packaging. Offers unparalleled scale, cost-effectiveness, and a rapidly growing domestic market for finished cosmetics.

- Considerations: The primary global source for cosmetic packaging and a growing force in finished cosmetic production.

Here’s a simplified comparison:

| Country | Known For (Cosmetic Products) | Packaging Focus (Often) |

|---|---|---|

| South Korea | Skincare innovation, K-Beauty trends | Innovative, trendy, functional |

| Japan | High quality, J-Beauty, meticulous R&D | Elegant, precise, high-tech |

| France | Luxury, perfumery, heritage brands | Classic, sophisticated, premium materials |

| Italy | Color cosmetics, private label manufacturing | Stylish, often linked to fashion trends |

| China | Manufacturing scale, diverse product offerings | Cost-effective, vast range, custom solutions |

For my clients like Anna in Thailand, who manufactures her own cosmetic line, she looks to countries like South Korea for formulation inspiration but often sources her packaging from China (through us at ShineTop) for the balance of quality, customization, and cost.

Which Country Imports the Most Cosmetics?

Understanding which countries have the highest demand for cosmetics can inform market entry strategies. Large import markets often indicate sophisticated consumers and significant sales opportunities.

The United States and China are typically among the largest importers of cosmetics globally. Other significant importers include Germany, the United Kingdom, and Hong Kong (often as a re-export hub).

The global flow of cosmetics is vast, with several key nations driving import demand. These markets are attractive targets for cosmetic brands looking to expand internationally.

Top Cosmetic Importing Nations (General Trends):

-

United States:

- A massive and diverse consumer market with high demand for a wide range of cosmetic products, from mass-market to luxury. Imports from all over the world, including Europe and Asia.

-

China:

- A rapidly growing market with increasing consumer sophistication and demand for international brands, especially in the premium and luxury segments. Imports heavily from South Korea, Japan, France, and the USA.

-

Germany:

- One of the largest cosmetic markets in Europe, with strong demand for natural and organic products, as well as established international brands.

-

United Kingdom:

- A significant market with diverse consumer preferences, importing a wide variety of cosmetic and personal care products.

-

Hong Kong SAR:

- Serves as a major trading hub and gateway to mainland China. A significant portion of its cosmetic imports are re-exported.

-

Japan:

- While a major producer, Japan also imports cosmetics, particularly from Western luxury brands and trendy K-beauty products.

It’s important to note that import figures can fluctuate based on economic conditions, trade policies, and evolving consumer trends. Data from sources like UN Comtrade, World Bank, or industry market research firms (e.g., Euromonitor, Statista) provide detailed statistics.

For a packaging supplier like ShineTop, these large import markets for finished cosmetics also represent significant opportunities. Brands selling into these markets need high-quality, compliant packaging. Mohammed, my client in Iraq, sources packaging from us to create products that his customer, with strong marketing capabilities, can successfully sell into competitive Middle Eastern markets, which also see significant cosmetic imports.

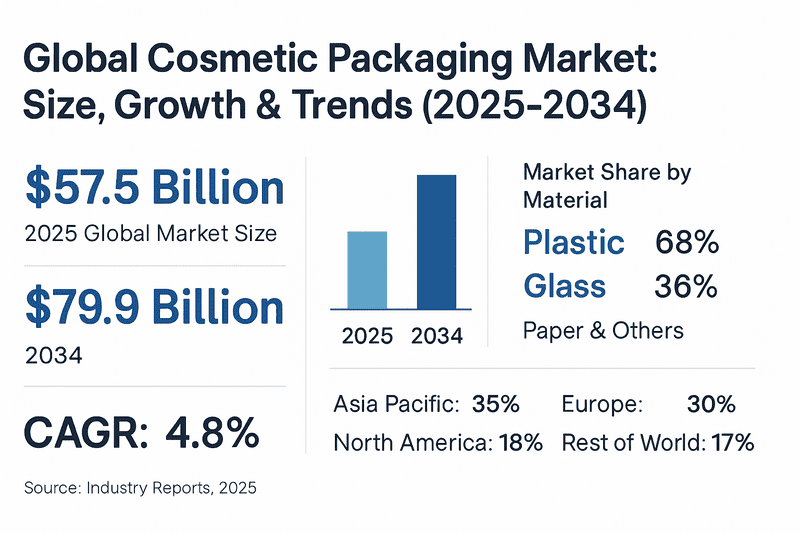

How Big is the Cosmetic Packaging Market?

The scale of the cosmetic packaging market reflects the immense size of the global beauty industry. Understanding its value helps appreciate the opportunities and competition within this sector.

The global cosmetic packaging market is a multi-billion dollar industry, estimated to be worth over USD 30-35 billion annually, and is projected to continue growing due to rising demand for cosmetics, innovation in packaging, and the growth of e-commerce.

The cosmetic packaging market is substantial and dynamic. Its growth is closely tied to the overall expansion of the beauty and personal care industry worldwide.

Factors Driving Cosmetic Packaging Market Growth:

- Increasing Demand for Cosmetics: Rising disposable incomes, growing awareness of personal grooming, and social media influence are boosting global cosmetic consumption.

- Product Innovation: New cosmetic formulations and product categories (e.g., clean beauty, men’s grooming, personalized cosmetics) require new and specialized packaging solutions.

- E-commerce Expansion: The growth of online beauty sales necessitates packaging that is not only attractive but also durable enough for shipping and provides a positive unboxing experience.

- Sustainability Concerns: Consumer and regulatory pressure for more eco-friendly packaging is driving innovation in sustainable materials and designs (e.g., PCR plastics, refillable systems, mono-material packaging). This is a key area of focus for us at ShineTop.

- Premiumization: Consumers are increasingly willing to pay more for products with perceived higher value, and premium packaging plays a crucial role in conveying this.

- Emerging Markets: Rapid growth in cosmetic consumption in regions like Asia-Pacific, Latin America, and the Middle East & Africa is fueling demand for packaging.

Market segmentation is typically based on:

| Segmentation Criteria | Examples |

|---|---|

| Material Type | Plastic (PET, PP, PE), Glass, Metal, Paper & Paperboard |

| Product Type | Bottles, Jars, Tubes, Pumps & Dispensers, Caps & Closures, Sachets |

| Application | Skincare, Haircare, Makeup, Fragrances, Personal Care |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

The Asia-Pacific region, particularly China, holds a significant share of the cosmetic packaging market, both in terms of production and consumption. As a manufacturer with extensive facilities in South China, ShineTop is at the heart of this dynamic market, serving clients across four continents.

Which Country is the Best Manufacturer of Cosmetics?

Identifying the single "best" manufacturer country is complex. Different countries have strengths in specific areas, from luxury formulations to mass-market production and ingredient sourcing.

China is the largest manufacturer of cosmetics by volume globally. However, countries like France, Italy, South Korea, Japan, and the USA are renowned for specific expertise, quality, and innovation in cosmetic manufacturing.

No single country holds the title of "best" for all aspects of cosmetics manufacturing. It depends on the criteria: volume, specialization, innovation, or cost.

Leading Cosmetic Manufacturing Countries & Their Strengths:

-

China:

- Strengths: Unmatched production capacity for a vast range of cosmetic products (from mass to mid-market), cost-effectiveness, speed to market for large volumes, and a rapidly improving R&D landscape. Also, the leading global hub for cosmetic packaging manufacturing.

- Focus: High-volume production, private label, increasingly sophisticated domestic brands.

-

France:

- Strengths: World-renowned for luxury cosmetics, perfumery, high-quality active ingredients, and sophisticated formulation expertise. Strong regulatory framework.

- Focus: Premium and luxury brands, skincare, fragrances.

-

Italy:

- Strengths: A global leader in color cosmetics (makeup) manufacturing, particularly for private label. Known for excellent formulation, trend responsiveness, and high-quality pigments.

- Focus: Makeup (foundations, powders, lipsticks, eyeshadows).

-

South Korea:

- Strengths: Highly innovative in skincare formulations (K-Beauty), advanced R&D, unique ingredients, and rapid product development cycles.

- Focus: Skincare, sheet masks, BB/CC creams, innovative textures.

-

Japan:

- Strengths: Known for meticulous quality control, advanced scientific research in skincare (J-Beauty), high-performance ingredients, and stable formulations.

- Focus: Premium skincare, sun care, functional cosmetics.

-

USA:

- Strengths: Large domestic market, diverse manufacturing capabilities (from indie to multinational brands), strong in R&D, and home to many contract manufacturers.

- Focus: Wide range of products, including skincare, makeup, haircare.

-

Germany:

- Strengths: Strong in natural and organic cosmetics, high manufacturing standards, and efficient production processes.

- Focus: Natural/organic skincare, dermo-cosmetics.

For brands like Anna’s in Thailand, she might develop her formulations inspired by K-Beauty or J-Beauty principles but then leverage the manufacturing scale and cost-effectiveness of either local Thai contract manufacturers or potentially Chinese facilities for certain components or larger runs. The choice often comes down to balancing quality, cost, innovation, and the specific needs of the product line.

As a packaging provider, ShineTop works with cosmetic manufacturers and brands globally. Our role is to supply the high-quality, innovative, and often custom-designed packaging that these diverse manufacturing hubs require to bring their products to market successfully.

Conclusion

China stands out for importing cosmetic packaging due to its manufacturing scale and cost-effectiveness. However, the "best" country for cosmetic products or manufacturing depends on specific needs like innovation, luxury, or specialization, with countries like South Korea, France, and Italy playing key roles.